Currency wars are one of the reasons why the capital of many subjects directed towards investment in those assets in which the chances of manipulation kept to a minimum. Through a review of the relationship of trust in cryptocurrencies, as well as trust in institutions in this work is estimated what impact will the mechanisms on which is based the virtual money have on total cash flow in the future and what kind of perspective of bitcoin and other cryptocurrencies.

The electronic currency bitcoin is gaining popularity, although for a long time, most economists around the world did not give it importance until its value started its dizzying growth. There are three key reasons why bitcoin gained popularity in a short period: 1) simplicity in transferring value; 2) the ability to perform microtransactions; and 3) growing trust in decentralized systems.

Simplicity in transferring value was recognized as one of the main achievements of digital money. In the history of human relations, changes in the way of material exchange determined the transition to a new level of civilization. After the multifaceted exchange of goods for goods became more orderly with the emergence of certain units of measure of equal value, there was a need for such a system to be simplified to provide more precision and clarity among trading parties.

Also, since goods were often perishable, it was necessary to establish what could be a value guard. Due to its limitations, the price and scarcity of gold could not play this role for a long time, resulting in the emergence of money for the development of the culture of Phoenicians, where all goods could be paid. As with most types of money, bitcoin, as digital money, is also characterized by the change in its value.

The value of bitcoin changes on a daily and even hourly basis. However, the advantage of bitcoin is the possibility to have microtransactions, especially with online payment services that cost less than the smallest unit of a currency.

For example, if a site owner wants to charge for access to content, counting on the number of visits, it is much easier to calculate these values in bitcoin than in traditional money, especially for services priced at one or two cents. The difference between one and two cents is still double in traditional currencies. With bitcoin, the price may be expressed in as many decimals as necessary to meet the most precise measurements. While these differences may be negligible at the individual level, when multiplied by thousands or millions on a daily or annual basis, the variations in earnings are enormous. Additionally, there are no transaction costs, such as those in electronic banking, to enable intermediary earnings from commissions.

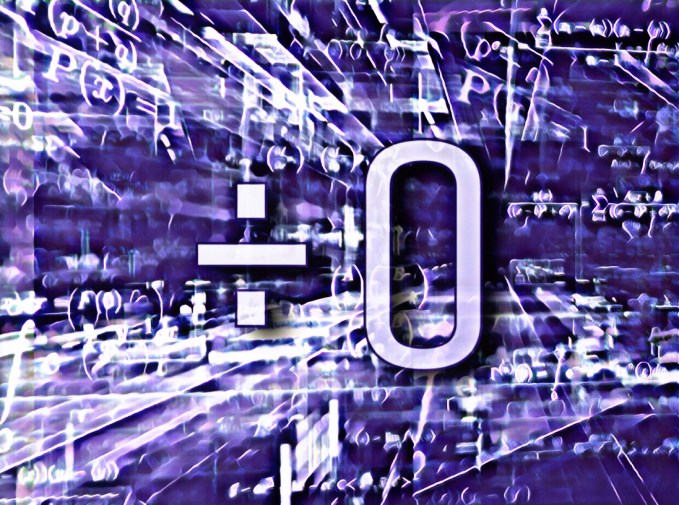

This article is part of the academic publication Dividing by Zero by Ana Nives Radovic, Global Knowledge 2018