The words of the president of the European Central Bank Mario Draghi that have shown his call for insurance on future liquidity made an impact on the price of gold and silver. However, they have also raised many questions regarding the repeating of economic cycles and situations brought through them.

The words of the President of the European Central Bank, Mario Draghi, have shown his call for insurance on future liquidity, making an impact on the prices of gold and silver. However, they have also raised many questions regarding the repetition of economic cycles and the situations brought about by them.

We live in times when entrepreneurs are seeking to finance reasonable projects, while companies with products, customers, and profits are looking for savings to grow. There is still an ongoing process of finding a way to finance these projects of the real economy, garnering capital gains, and collecting interests. It is shown as extremely hard during this type of political control of the central banks that will not change a flawed monetary and financial system due to the lack of discipline. Under pressure from more than 200,000 billion dollars of debt, the announcement of the ECB that it will strengthen control of interest rates could happen very soon.

What the history of finance has shown is that the control of the price of credit by the state, like any control of this kind, will end in disaster. The state does not have to control the currency, the price of credit, or the economy, since the role of the government should be limited to ensuring equal rights between citizens and ensuring that they are respected.

While trying to emerge from unusual monetary policies, numerous examples of panic-driven measures can be seen. The current policies of the ECB do not differ much from what was prescribed in the Code of Hammurabi, turning the king into a god and leaving numerous people in the class of slaves. The difference, however, is that while adjusting the amount of money in current flows, it seems like the ECB does not know what to do with its “Print,” “Rate,” and “Delete” buttons. There is a strong need to make a movement in order to prepare for the end of monetary creation in the euro, but the mechanisms to do so are not in sight.

This reveals another situation of repetition of numerous times viewed situations that led to the same myths. One of them is that public money creates more wealth than private money, which is called the Keynesian multiplier. In this situation, if the government invests one euro, its return on investment will be higher than that of private persons. According to this belief, at the same time, the government is not obliged to forcefully stab taxpayers. It can simply borrow because its return on investment will always be positive. While a wretched single entrepreneur, pursuing his guilty selfish interests, may be mistaken, since the business may go bankrupt when its return on investment appears to be negative. Keynesians define the multiplier coefficient as the ratio between a change in public expenditure and the consequent change in total income. This explanation justifies the stimulus policies financed by the loan.

The ECB still injects 60 billion euros each month into the markets in order to keep interest rates low, and this trend is lasting, considering the unfortunate state of public finances of the eurozone countries. The Keynesian multiplier also relies on the strange belief that consumption enriches and the thought that when people do not consume enough, what the government should do is just to distribute them money, created from nothing, taken from others, borrowed, whatever, which will combat economic depression and unemployment. This, however, ruins all hopes of achieving a decent return in the years to come.

Technically, the ECB is more autonomous in relations with the governments, though in practice, this independence is completely apocryphal. The decisions of the ECB are essentially made in the interests of several eurozone governments. By artificially lowering interest rates, the ECB could facilitate public debt, and by financing commercial banks lending to the eurozone countries, they guarantee to the latter an almost unlimited source of income, despite their already enormous debt. For Keynesians, this situation might seem satisfactory, but its outcome is the credit market that becomes completely distorted. Resources are allocated unproductively, contributing to slowing economic growth and thus reducing poverty.

The fact is that the large capital gains are no longer on the stock market, where central banks inject thousands of billions to inflate prices, but before the IPO and even in private equity transactions. Since 2012, the money of the insiders drained by venture capital is increasing considerably. The average real return on life insurance was 1.8% in 2016. In today’s markets, listed companies are now too big and too disconnected for their shareholders to be really involved in decision-making. Also, the banking crisis is still threatening, and the European system is far from being consolidated. This all leads to a conclusion that the current monetary system, based on unrestricted credit, is a new form of crime against humanity.

There is a strong need to adopt a different approach as the mass of credit is used to protect from bankruptcy the weak links used by the parasitocracy. In these situations, banks with doubtful debts, multinationals cooperating in ruinous public projects, and expensive social spendings in southern eurozone countries.

If we return to the comparison of the current situation with the ancient one, we will see that it was not the king or the emperor who decided that gold or silver was the best suited to trade and exchange, but it was a crowd of individuals, now fallen into dust, who have come to this conclusion. In their situation, gold was imposed in a pragmatic and democratic way simply because it worked best, while the so-called added value of a centralized system imposed by a ruler was limited to a seal certifying purity and weight. There should be noted that elites hate gold but have not dared to make the last move since central banks still have a gold reserve. Today central banks still have their treasuries, or at least, that is what is being said, while the people bother to rate precious metals. In the current situation, the dollar and the euro have fallen against gold (and silver), while the dollar dropped more than the euro. As is the case anywhere else, there is value and price. Value is what each one attributes at a given moment to something, that is, the satisfaction that everyone anticipates of possessing something one desires the most — the price is what an individual agrees to pay according to his own value scale.

Three key problems have become more visible under these circumstances. The first one is that zero interest rates and generous liquidity kept the dying business alive, inflating supply. In all sectors, there is an oversupply of everything, where marginal companies have been able to continue to function even though they are fading, generating just enough income to borrow more money and to postpone the repayment of their debts. The second problem is that the income was carried by steady growth in social security contributions instead of salaries. The third problem is that the majority of employers are unable to afford to pay higher wages without considering the labor market as they are faced with ever higher costs, while their power over prices is zero because of the surplus supply. Confronted with a total lack of power over prices and higher costs, employers can either increase the working hours of their current employees or hire part-time workers without contractual benefits.

These three problems represent the most visible effects of monetary measures implemented by the ECB. By market capitalization with the money achieved by borrowing, instead of balancing the market, the ECB creates an even greater problem of social stratification, making part of the companies and therefore a huge part of the population literally slaves. As it was prescribed by the Code of Hammurabi, anyone who attempts to counter financial movements to these flows in order to facilitate the position of slaves receives a fatal outcome.

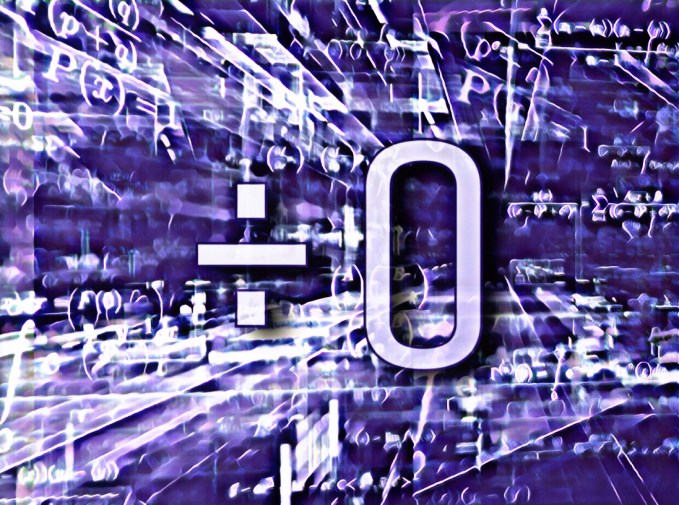

This article is part of the academic publication Dividing by Zero by Ana Nives Radovic, Global Knowledge 2018