Beyond the hesitancy of the legislator, the response of the banks to the questioning of their profession is also strongly to be feared. From this standpoint, it might seem that the banks have not yet realized that a peer-to-peer system, the bitcoin is based on, reduces the scope of depository banks since a bitcoin deposit does not exist as such. It is hard to see how the banks could justify their deposit services under Bitcoin.

The ongoing printing of money that occurred in Japan, the United States, and China also happened in the EU, which, in general, created an image of unsustainability, especially in the longer term. The generally accepted opinion is that the global scene today is characterized by currency wars of enormous proportions due to the fact that the United States, followed by Japan and later China, and finally the European Central Bank, began to introduce monetary incentives through additional printing money or programs to purchase bonds that increase the level of available resources but also cause a condition that is unsustainable in the longer term.

While for the economies of these countries, this was a signal that in the future could be a very complex problem, global financial centers have recognized it as a generous source of earnings. Changes in exchange rates were conditioned by political and economic developments in the countries that use them but also moved behind the scenes pulling the leading banks in the world, after which it seemed that once completely reliable guarantor factors are not expected to reverse the trend.

Forex trading, which became increasingly popular over the past decade, has attracted millions of users around the world, contributing to the vertiginous growth of the daily trading volume, a growing number of those who observed the legality of trading and the ability to predict the directions of growth, but also an increasing number of reports that start with the word “despite” and explain a situation in which there was an unexpected change in circumstances.

Since there are logical rules based on which the trends of changes in exchange rates can be predicted to the fifth decimal, but since, at the same time, one may also come up with unexpected shifts in this area, there is only one possible explanation, and that is that there are devices used to manipulate to enable additional income for certain entities. The currency market is huge and it continues to grow, which prevents any intervention, agreements, and coordinated actions of several participants with high stakes, especially so that it reflected at the global level could shake up relations between currencies. This does not mean that some are not able to influence the courses.

The mismatch of the political situation, reports on the economic growth of a country, inflation, employment data, and other parameters with courses of leading world currencies is explained as an outcome of activities performed by the biggest global banks. As one of the key subjects of currency exchange various mechanisms are contributing to the instability of exchange rates, mostly because a huge proportion of them are related to speculative schemes. In such an environment, only about five percent of foreign exchange transactions are related to investment, trade in goods and services that have an impact on the real economy, as well as remittances from inhabitants from abroad, while the rest of the leading banks in the world belong to the segment from which derive key sources of funding and the duration of, or in the currency exchange and the commission that thanks to the exercise.

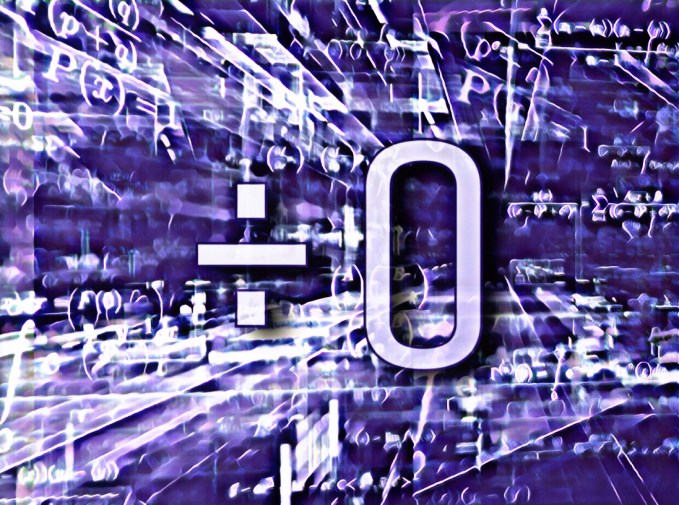

This article is part of the academic publication Dividing by Zero by Ana Nives Radovic, Global Knowledge 2018