From a certain point that the markets have already achieved, banks will no longer be capable to boost credit amount to reimburse for losses from their central bank, which might clarify the disintegration of the banking sector.

The scenario involving negative interest rates signifies an unconventional structure where the borrower deducts a calculated amount from what they owe, based on the agreed-upon rate between the contractual parties. Essentially, the more one borrows, the less one will need to repay.

The emergence of negative interest rates poses a certain threat, and this concern is becoming more evident in Europe. It poses a risk to financial independence and economic expectations in the region.

For over seven years, the Federal Reserve of the United States maintained its rate at nearly zero. However, a significant shift occurred in December 2015 when the Federal Reserve announced its first interest rate increase. Since then, global markets have entered a new phase of monetary policy known as “exceptional”, adopted by nearly all central banks worldwide following the financial crisis of the previous decade.

The key question revolves around whether the ongoing progress in this new direction will impede the sluggish economic recovery. As financial and economic entities have grown reliant on easy money, there is uncertainty about their ability to adapt to higher interest rates. Hence, observers are keenly trying to decipher potential outcomes by the year’s end.

The global landscape features numerous markets, with Europe being a notable example where central banks are diverging from the norm by initiating a negative interest rate policy for the first time. The gradual decline in interest rates has taken on a new dimension, demonstrating its effectiveness in allowing many countries to reduce their indebtedness. This is achieved through the injection of free liquidity into banks, which then becomes a tool for governments to manage their financial obligations. In the case of the European Central Bank, the primary focus is on injecting money into the financial system, fostering a more accommodating environment for indebted countries – a pathway that is becoming increasingly apparent.

Many national central banks have expanded their balance sheets by acquiring lower-rated bank debt, effectively injecting financial institutions with free money. However, these institutions, in their pursuit of higher yields, may inadvertently step into the danger zone by investing in assets where the nominal yield fails to adequately compensate for the risk of potential collapse.

This particular scheme would unlikely be entertained in a financial system priced close to historical averages. The cash ready for investment has been anticipated as a catalyst for economic growth. Nevertheless, the compensation offered may not be sufficient to entirely mitigate the risk of these funds experiencing a breakdown.

Moreover, this strategy was executed under the assumption that banks would continue offering money at reduced rates for at least a year. In this scenario, where interest rates hover around zero, banks generate returns after loaning money to others who, in turn, pay a somewhat higher interest rate to access those funds. Consequently, the bank realizes varied income streams through this diverse financial arrangement.

The standard interest rate serves as a gauge of the interaction between the present and the future, reflecting expectations of future prosperity. This dynamic is why interest rates tend to be higher in economically challenged countries, where the opportunity cost of time is minimal. Conversely, the financial interest rate, directly or indirectly influenced by central bank policies, signifies the cost of available money at a specific time. Any deviation from the norms of these two scenarios can potentially trigger a crisis, where money is offered without adherence to economic principles.

Negative interest rates come into play when individuals deposit their capital in the bank, turning it into a cost rather than a return. In times like these, conventional savings lose their appeal as they fail to yield any noticeable gains. Instead, borrowing becomes more attractive, as the amount to be repaid is lower than the sum borrowed, creating a distinctive financial landscape.

In such a scenario, traders often resort to an alternative strategy to unearth yields, engaging in speculative dealings and transactions involving commodities like oil and gold. However, the presence of zero or negative interest rates has a detrimental impact on the overall value of investments, promoting negative rates on savings without any corresponding performance. The inherent issue lies in the elevated risk associated with banking balance sheets, and the cost of potential losses is inevitably borne by investors, irrespective of their risk aversion.

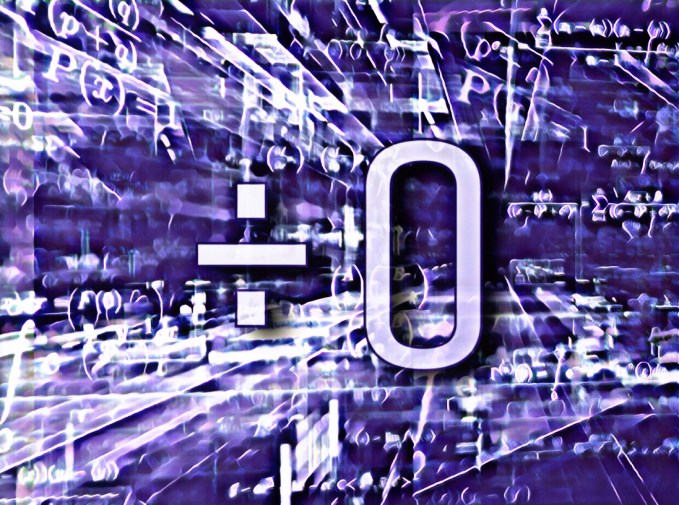

This article is part of the academic publication Dividing by Zero by Ana Nives Radovic, Global Knowledge 2018